Getting fha loan with poor credit

Very Poor. If you can make a 10 down payment your credit score can be in the 500 579 range.

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

For FHA-backed loans this means poor credit scores dont necessarily require higher interest rates.

. In the US the Federal government created several programs or government sponsored. You only need a credit score of 600 to get approved for an FHA loan. FHA lending limit for your county.

The VA has no minimum credit requirement though lenders can set their own Rocket Mortgage requires a minimum score of 580 for a VA loan. Here are the pros and cons of getting an EIDL loan. Even if the mobile home is in poor shape or too old to finance you could still be approved based.

Contact a HUD-approved housing counselor or call 800 569-4287. Best USDA Mortgage Lenders Best Mortgage Lenders for FHA Loans. Borrowers with low or poor credit scores may obtain FHA loans.

Take a cash-out refinance. You take on a higher-balance loan and in exchange your lender gives you the difference in cash. Each FHA loan requires both an upfront.

FHA refinance loans can be open to those with poor credit including people with a FICO credit score as low as 500 depending on the type of transaction. FHA might be just what you need. Make sure you understand the terms and requirements before applying.

Fortunately even if you have a low income a poor credit score or negative marks in your. A minimum of 500 preferably 580. An FHA loan requires a minimum 35 down payment for credit scores of 580 and higher.

An FHA loan is another type of government-backed loan for moderate-income and low-income borrowers. Ask an FHA lender to tell you more about FHA loan products. Those usually not approved for credit.

A lender can provide you with an actual loan amount. Buying your first home. Minimum credit score 580 with 35 down or 500 with 10 down.

But to fulfill the requirement you must provide a 10 down payment. Getting pre-approval is a sign that youre a serious homebuyer which is. FHA Requirements Credit Benefits Improving Credit.

What does FHA have for you. For many home buyers using an FHA loan can really make the difference between owning your dream house comfortably or turning it into a financial nightmare. Please use the Find a Loan Officer link or reach out to Mortgage Investors Group at 800-489-8910.

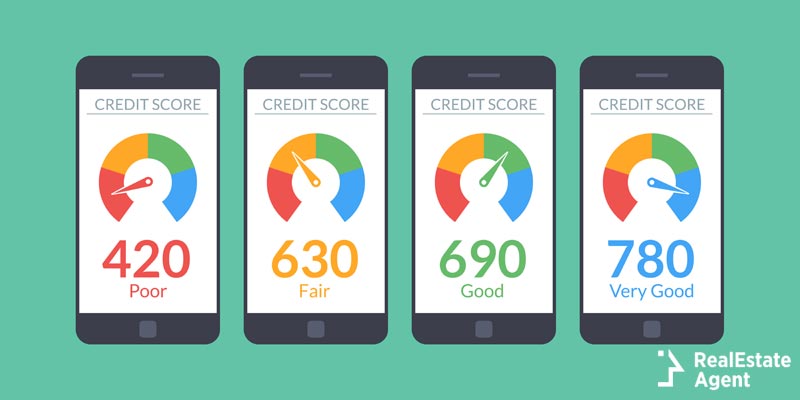

Most lenders require a minimum credit score of 580 and a 35 down payment for an FHA loan but you could qualify with a credit score between 500 and 579 and a 10 down payment. As you can see borrowers with the highest scores are entitled to the lowest rates. The FHA minimum credit score is 500 with a down payment of 10 or more.

In general your credit score doesnt need to be high. When homeowners default on their FHA loan HUD takes ownership of the property because HUD oversees the FHA loan program. FHA loan requiring 35 down payment.

Many homeowners refinance their FHA loan to a conventional loan after they achieve 20 equity for this same reason. A good FICO score is key to getting a good rate on your FHA home loan. Ideally 620 and up.

An FHA Title I loan can be used for refinancing a manufactured home as well as purchasing one. Rocket Mortgage requires a minimum credit score of 580 for FHA loans. Find an FHA lender.

You must qualify for a loan with an FHA-approved lender. 680 Good - 640-679 Fair 620-639 or Poor- Below 620. Getting a home loan with bad credit is possible through conventional and government-backed programs.

A cash-out refinance allows you to draw money from your home equity to cover outside expenses. If your credit score falls between 580 to 579 you are still eligible for an FHA loan. Youll need a 580 credit score to make the minimum down payment of 35.

5 EIDL Loan Terms and Requirements You Should Know. However most FHA loans require a down payment of at least 35. If your credit score is at least 580 you are allowed to make a 35 down payment based on the homes purchase price.

Your down payment can be as low as 35 of the purchase price. If you have a complaint about an FHA loan program contact the FHA Resource Center. FHA loan requiring 10 down payment.

September 7 2022 - Some borrowers come to the FHA loan process with a long credit history while other borrowers are just getting started. Getting a car loan with bad credit is still possible though you need to be careful of high rates and fees. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

620 is the minimum qualifying credit score for this product. An MIG Loan Officer is available to help with your financial details to determine which characteristics apply to your situation for a personalized look into which loan program best fits your home financing needs. 500 Rocket Mortgage requires a minimum score of 580 for an FHA loan VA loan.

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

How To Get A Va Loan If You Have Bad Credit

How To Get A Loan With Bad Credit Real Estate Tips

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

Fha Credit Requirements For 2022 Fha Lenders

About The Benefits Of An Fha Home Loan Housing Advice

Buying A Home With Bad Credit In Grand Rapids Mi Michigan Bad Credit Mortgage Loans

How To Get A Business Loan With Bad Credit Forbes Advisor

How To Refinance A Mortgage With Bad Credit Money

How To Get Approved For Fha Loans For Bad Credit Youtube

Fha Loan With No Credit 2022 Guidelines Fha Lenders

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

Pin On Best Real Estate Pins

How To Get A Mortgage With A Low Credit Score Recognized Brands 65 Off Backup Goldenvillagepalms Com

Getting A Mortgage With Bad Credit Is It A Good Idea Oregonlive Com

How To Buy A House With Bad Credit Or No Credit